A caring and sustainable budget – striking a balance post pandemic

The annual draft budget speech by the mayor of Stellenbosch, Adv Gesie van Deventer, was delivered last week and in her speech she reiterated the fact that the budget is a strictly needs driven budget with no room for ”nice to haves”.

Total expenditure budget overview

The tabled 2021/2022 capital budget expenditure rounded amounts to R398 million and the operating budget expenditure amounts to R2,017 billion.

The total budgeted expenditure amounts to R2,414 billion compared to the current budget of R 2, 282 billion. This amount is estimated to increase to R2, 468 billion and R2, 567 billion respectively for the two outer years of the MTREF.

Capital budget expenditure

The tabled capital budget decreased from R454,4 million in 2020/2021 to R397,7 million in 2021/2022. This is in part due to the completion of several major capital infrastructure projects.

The MTREF proposes capital expenditure of R 384,5 million and R 381,5 million for the two outer financial years.

“Our focus is on fulfilling our core mandate of service delivery and caring for the needs of our community and for that purpose the largest part of our capital budget has been directed towards infrastructure over the next three years.

“Maintaining, replacing and updating aging or out-of-date infrastructure, as well as our providing for our growing towns, necessitates sufficient investment in infrastructure that will support our economic growth and recovery as we move beyond the pandemic. Across South Africa we continue to see what happens to basic service delivery when sufficient investment in infrastructure has been neglected,” Van Deventer said.

Van Deventer said the focus for the next financial year will be on infrastructure investment, ensuring a solid base on which to build our economy, creating opportunities for economic recovery.

“An important step in this process is setting tariffs as low as possible to make it possible for residents to recover from the disastrous effects of COVID. This budget is aligned to Stellenbosch Municipality’s Integrated Development Plan (IDP) with its vision statement, mission statement, corporate values, key performance areas and its key focus areas but also from inputs by all councillors and our communities’ right through the year.

“This budget is fairly distributed to ensure a fair cut for all communities, taking into consideration the impact of COVID, load shedding and the economic climate. We have been conservative in our planning, not knowing how COVID will continue to affect our local economy,” Van Deventer said.

The various tariffs set by the municipality is not all doom and gloom and is in summary set as follows:

- Electricity tariffs increase with 14.59% (This is an increase imposed by NERSA.)

- Water tariffs increase with 5.5% (last year the increase was 6.00%)

- Sanitation tariffs increase with 6% (last year 6.50%)

- Refuse removal tariff will increase with 12% (last year 16.50%)

- Property rates has a decreased tariff by 17.17% for residential property, 17.28% for agricultural property and 20.93% for business property.

The rate rebate threshold has been increased from R200,000 to R250,000 for properties valued less than R5million. This rebate means residents with properties of less than R5 Million in value are exempt from taxes on the first R250 000.

This is what the money will be used for:

Water:

Electricity

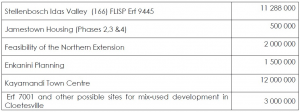

Human Settlements:

Table

Table

Upgrades:

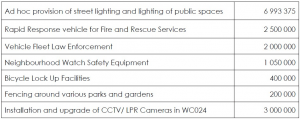

Safety and Security:

Roads and Traffic:

Cleaner Communities and Environment:

Sport Facilities and Parks:

Transport:

Capital Budget Funding

The capital budget is funded from the following funding sources –

* Own reserves (Capital Replacement Reserve)

* External loans to be taken up

* Government grants and

* Public Contributions and donations.

Operating Budget Expenditure

The proposed operating budget expenditure sees an increase in annual operating expenditure from R1, 827 billion in 2020/2021 to R2, 017 billion in 2021/2022. This 10.36 % increase is primarily due to increases in several expenditure categories, our operating expenditure for the 2022/2023 to

2023/2024 outer financial years will increase respectively to R 2, 083 billion (3.28%) in 2022/2023 and R 2, 186 billion (4.94 %) in 2023/2024.

The main contributors to the operating expenditure of the 2021/2022 financial year are –

- Employee related costs

- Remuneration of Councillors

- Depreciation and impairment

- Finance Charges

- Bulk electricity and water purchases

- Other expenditure

Operating Budget Revenue

The additional revenue will be obtained from interest on selected investments, traffic fine income and various other revenue items. The municipality have conservatively budgeted for its operating revenue due to the current economic challenges faced by the country that will directly impact on Stellenbosch residents.

The overall proposed revenue budget increase was limited to 9.28% resulting in annual operating revenue increasing from R1, 928 billion in 2020/2021 to R2 125 billion in 2021/2022.

Financial support to indigent households

Stellenbosch Municipality does provide free basic services to poor households as a means of poverty alleviation. We mainly provide support to households who are unable to pay or struggle to pay for their basic services.

This includes households with an income base below a determined threshold (two times the government social grant paid to a pensioner plus 25%), to the unemployed, child-headed households, retired persons and disabled persons.

Indigent households in 2021/2022 will receive:

* 100 units of free electricity per month;

* 6 kilolitres of free water per month,

* free refuse removal services,

* free sanitation services.

The income bands and rebates for the effective financial period of the Rates Policy are as follows:

Gross monthly household income

Up to 8 000 100%

From 8 001 to 10 000 75%

From 10 001 to 12 000 50%

From 12 001 to 15 000 25%

Public participation

The public participation process will be done differently than in the past, as COVID-19 restrictions need to be taken into consideration. This process will be duly communicated. The mayor and mayoral committee will consider all the comments received on the reviewed IDP and budget from the local community, stakeholders, national and / or provincial treasury, councillors and senior management before it will be tabled as the final budget before council for final approval before 31 May 2021.